Raising a fund for your startup is challenging.

Often it can seem like an impossible mission.

Yet, in my experience with hundreds of startup companies, your chances to get an investment to your startup will be based mainly on two factors:

- You are the type of founder the investors trusts to succeed.

- You manage to convince the investors there is true potential and need for your product in the market.

These are the two things you should focus on in your presentation.

Regarding the 1st factor; for more than 10 years, investors have told me that the number one factor they look for in a startup is people. It sounds like empty words, something that sounds good, but doesn’t mean anything. But, I realized it’s true. How? I started noticing clear patterns among the founders whom each angel or venture capitals chose to fund.

Unfortunately, there isn’t a magic or easy solution for the 1st factor, and I can’t really help you here (however, I do have one tip that I’m sharing with at the end of this post).

There are definitely ways to help and guide you with the 2nd factor of finding and showing your potential investors the biggest market opportunity for your startup. During the last ten years, we cracked the code for doing exactly that together with startups looking to raise their investment. And it was proved to work over and over again for hundreds of startup companies.

Surprisingly (or not…) it’s exactly the opposite of what most startups tend to do…

Most startups start creating their venture by solving a problem they think many people have.

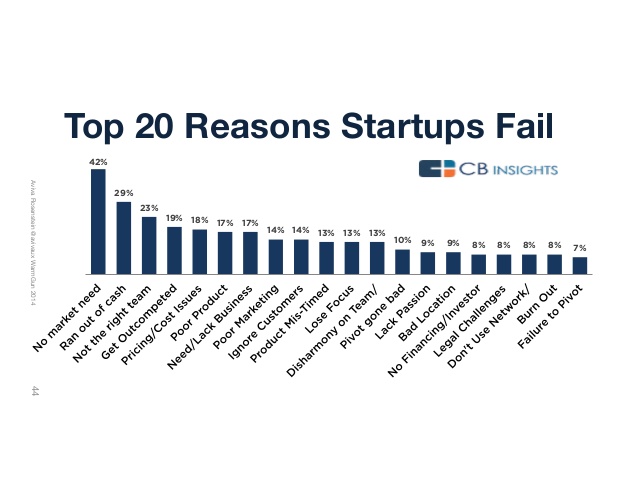

Having say that, it’s surprising to know that the number one reason entrepreneurs that their startup fail give for their failure is, “there was no market need.”

Resource: CBInsight

How come? If most entrepreneurs start with “solving a problem they think many people have”, how come that the number one reason for their failure is “no market need”?

Because it’s almost impossible for one to tell what other people need or want.

The best advice of almost all successful entrepreneurs and opinion leaders I interviewed

The young most successful entrepreneur Tom Charman (was named one of 20 young entrepreneurs to watch 2017) told me in an interview:

“The most important thing is that you understand who your market is, and that you build something that they will use.

Too many times I see entrepreneurs and people who want to start a new business think that because they have the problem, everyone has the problem.”

Jeremiah Gardner, who I interviewed recently about his customers’ approach, beliefs, successes and failure gave a clear answer:

“…We can’t, as human beings, predict the future. If we spend a lot of our time trying to predict what customers will do, or building funnels without actual data, or launching products without any validation; we are likely to fail.”

Jeremiah’s advice for entrepreneurs is:

“You have to embrace the unknown and get outside of your building and get in front of your customers, taking their input and behaviors, and follow them.

Entrepreneurship is built of skills and a mindset. It isn’t only about following your passions or dreams. This is a skill, to practice, to experiment; it’s a skill to follow your evidence and it’s a mindset – accepting the uncertainty accepting that you don’t know and that you have to go out and explore.”

And it seems to be the best advice almost all successful entrepreneurs and opinion leaders I interviewed gave: Talk with your customers.

To listen to the best advices of Chris Brogan, John Lee Dumas, Guy Kawasaki, Kate Erickson and more

However, the question generally is what to do before we get the customers? How do we convince the investors there is a market potential?

How to convince investors there is a market potential?

What can we do before we have customers? Isn’t it what entrepreneurship is all about? How to convince potential investors to fund your startup in order to build that first viable product to show and test with customers?

We should find a way to understand what people do, want, and need before we come up with solutions.

Fortunately, in today’s digitally connected world, there is a great way to do it; by combining several resources together to learn about customers’ different points of view and behaviors.

See my latest article: The three free, practical steps to researching and locating your market

The best way to show future potential is by collecting maximum resources (it’s free!) to get a reliable Market Analysis to present to the investors.

A focused, reliable, and short market analysis should start with understanding what your idea of the product is.

One of the things I always tell in my lecturers is that, among hundreds of founders I have interviewed, only two founders of one startup defined their product the same.

So the first step for any investors’ presentation should start with studying your product and founders deeply through interviews with the startup founders. That will enable you to show the uniqueness and strength about your product and company.

Then we should search diverse verticals in the market to see which verticals are most suitable for your product.

And then at the 3rd step we will search the most relevant market’s verticals (as we found at the 2nd stage) deeper to learn about the customers: who are they, what are they looking for, what discussion they have about the problem your product is solving and more

It is possible today thanks to the fact that information and almost all discussions are out there on the free net.

What we look for is not only the people that your product can serve, but the innovators that will be the first to look for and adopt the product and will spread the word.

These combined resources will give an objective yet wide perspective that will allow us to see the trends and behaviors that show the market potential as well as the best way to reach these customers later on.

And my tip for the 1st factor:

The factor was, “You are the type of founder the investors trusts to succeed.” As I said, we can see clear patterns about the founders each investor chooses.

I’m sure you’ll be able to find successful entrepreneurs that share a lot in common with you (personality wise, technology wise, history, demography etc.). Contact them, let them know about you and ask them to introduce you to their investors, in case they are looking for more investments. As Investor Lou Kerner told me on my podcast interview, when I asked what the best way for entrepreneurs to contact him was:

“To contact me, it’s better to get through somebody else in the echo system, who I have good relations with, if somebody from a company I already invested in tells me they have a friend who has a great idea, who is a great guy… it’s much better from reaching out cold.”